Table of Contents

Powerful Perplexity AI Stock Analysis Techniques: Ever stared at a stock chart feeling like you’re trying to decode hieroglyphics? You’re not alone. Thousands of retail investors are drowning in data while hedge funds use AI to spot patterns you can’t even see.

But here’s the thing – Perplexity AI stock analysis techniques are changing the game for regular investors like you. No more guesswork or emotional trading decisions.

This guide will show you exactly how to leverage Perplexity AI to spot market trends others miss, analyze sentiment across social platforms, and make data-driven investment decisions without needing a finance degree.

The first technique we’ll cover? It’s completely reshaping how successful traders identify entry points – and it’s simpler than you might think.

Understanding Perplexity AI for Stock Analysis

What Makes Perplexity AI Different from Traditional Analysis Tools

Perplexity AI breaks the mold of traditional stock analysis tools by offering you real-time data processing with unprecedented context awareness. Unlike conventional tools that rely on predetermined parameters, Perplexity AI adapts to market conditions dynamically, giving you insights that evolve with the market.

Traditional tools often compartmentalize data, but Perplexity AI connects disparate information sources – from earnings reports to social media sentiment and macroeconomic indicators. This gives you a truly holistic view of market forces.

The difference becomes crystal clear when you’re tracking volatile stocks. While conventional tools might flag simple threshold breaches, Perplexity AI understands the nuance behind the numbers, helping you distinguish between temporary fluctuations and genuine trend shifts.

Key Benefits for Investors and Traders

With Perplexity AI, you’ll drastically cut down research time while expanding your information horizon. The platform delivers customized insights based on your specific investment style and risk tolerance.

You’ll particularly appreciate the pattern recognition capabilities that spot emerging trends before they become obvious to the broader market. This early-warning system gives you a critical edge in timing your entries and exits.

Risk assessment takes on a new dimension too. You’re not just getting simple volatility metrics – you’re receiving contextual risk evaluation that considers multiple factors simultaneously, helping you make more balanced decisions.

For day traders, the real-time sentiment analysis proves invaluable, tracking how market perception shifts throughout trading sessions.

How Perplexity AI Processes Market Data

Perplexity AI digests market data through a sophisticated multi-layered approach. First, you’ll notice it collects information from traditional sources like financial statements and price action, but then adds alternative data streams including social sentiment, executive communications, and even satellite imagery for physical operations assessment.

The processing pipeline transforms this raw data through natural language processing (NLP) models that interpret textual information with remarkable precision. You’re getting analysis that understands nuance, sarcasm, and implicit meaning in financial communications.

The system’s predictive models don’t just extrapolate historical patterns – they incorporate uncertainty through probabilistic forecasting. This means you receive predictions with confidence intervals rather than misleading exact figures, giving you a more realistic picture of potential outcomes.

What makes this truly powerful is the continuous learning mechanism. As you interact with the platform, it refines its understanding of your priorities and preferences, delivering increasingly personalized insights.

Setting Up Your Perplexity AI Analysis Environment

Essential Tools and Platforms

Getting started with Perplexity AI for stock analysis requires the right setup. First, you’ll need a reliable Perplexity AI account with Pro subscription for unlimited searches and deeper analysis. Your hardware matters too – a decent computer with stable internet connection ensures smooth operation when processing market data.

Some essential tools to add to your arsenal:

- Programming environment: Python with Jupyter notebooks lets you customize your analysis

- API integrations: Connect Perplexity AI with trading platforms like TradingView or MetaTrader

- Data visualization tools: Tableau or Power BI help transform complex findings into actionable insights

- Cloud storage: Secure solutions like Google Drive or Dropbox for backing up your models and research

Data Sources That Enhance Accuracy

Your analysis is only as good as your data. While Perplexity AI accesses many sources, supplementing with specialized financial data dramatically improves results.

Premium data sources worth considering:

- Bloomberg Terminal: Industry-standard for real-time market data

- Alpha Vantage: Affordable API for historical stock data and technical indicators

- SEC EDGAR: Direct access to company filings and financial statements

- Alternative data: Consumer sentiment from social media analysis and satellite imagery

Don’t overlook free options like Yahoo Finance and FRED (Federal Reserve Economic Data) to round out your research ecosystem.

Configuration Best Practices for Financial Analysis

Optimizing your Perplexity AI setup makes all the difference. Start with these configurations:

- Set your preferred market indices and watchlist stocks for continuous monitoring

- Configure custom alerts for price movements, volume spikes, and news events

- Create specific prompts templates for different analysis types (technical, fundamental, sentiment)

- Establish default time frames that match your investment horizon

Your prompt engineering matters tremendously. Instead of asking “Is AAPL a good buy?”, try “Analyze AAPL’s current valuation ratios compared to 5-year averages and sector peers.”

Security Considerations for Your Investment Data

When dealing with financial information, security isn’t optional. Your investment strategies and portfolio details need protection.

Implement these security measures immediately:

- Use a dedicated device or virtual machine for your trading activities

- Enable two-factor authentication on all financial platforms and Perplexity accounts

- Consider a VPN service when accessing markets from public networks

- Regularly audit which third-party apps have access to your financial accounts

- Powerful Perplexity AI Stock Analysis Techniques.

Remember to compartmentalize your research—keep strategy documents separate from execution platforms. This approach not only enhances security but also creates a cleaner mental framework for your investment decisions.

Fundamental Analysis Techniques Using Perplexity AI

Extracting Meaningful Insights from Financial Statements

Digging into financial statements doesn’t have to be overwhelming. With Perplexity AI, you can quickly uncover the story behind the numbers. Simply ask the AI to analyze a company’s income statement, balance sheet, and cash flow statements, and you’ll get clear insights without drowning in spreadsheets.

Try prompts like “Analyze Apple’s profit margins over the last 5 quarters” or “Explain Amazon’s debt-to-equity ratio trend.” The AI will highlight important metrics like:

- Revenue growth patterns

- Profit margin changes

- Cash flow sustainability

- Hidden liabilities

- Asset utilization efficiency

- Powerful Perplexity AI Stock Analysis Techniques.

You’ll spot red flags that others miss, like declining gross margins or increasing accounts receivable relative to sales. These early warning signs can save you from bad investments before the market catches on.

Competitor Analysis and Market Positioning

Getting the competitive landscape right is crucial for stock picking. Perplexity AI helps you compare companies side-by-side with incredible efficiency.

Ask “Compare Netflix, Disney+, and HBO Max subscription growth” or “Analyze Tesla’s market share versus traditional automakers.” The AI synthesizes data from multiple sources to show you:

- Market share trajectories

- Pricing power differences

- Product launch success rates

- Customer acquisition costs

- Brand sentiment trends

- Powerful Perplexity AI Stock Analysis Techniques.

This gives you a much clearer picture of which companies are truly winning in their industries, not just making noise. You’ll understand if a company has sustainable competitive advantages or is just riding a temporary trend.

Identifying Long-term Value Indicators

The best investments often reveal themselves through patterns that suggest long-term value creation. With Perplexity AI, you can spot these patterns faster.

Ask questions like “What R&D investments is Microsoft making in AI?” or “Analyze Nvidia’s intellectual property portfolio growth.” Focus on these value indicators:

- R&D efficiency (patents per dollar spent)

- Brand equity development

- Customer retention metrics

- Network effect strength

- Vertical integration opportunities

- Powerful Perplexity AI Stock Analysis Techniques.

You’ll discover companies building moats that Wall Street hasn’t fully appreciated yet. These moats protect profits and enable compound growth that powers multi-decade winners.

Industry Trend Recognition and Prediction

Spotting industry shifts early gives you a massive edge. Perplexity AI helps you recognize patterns across news, research, and data that signal emerging trends.

Try prompts like “What technologies are disrupting the healthcare industry?” or “Analyze adoption rates of renewable energy by region.” The AI will help you:

- Track adoption curves of new technologies

- Identify regulatory changes before they impact stocks

- Spot supply chain shifts that create winners and losers

- Recognize demographic trends driving demand changes

- Monitor changing consumer preferences

- Powerful Perplexity AI Stock Analysis Techniques.

This forward-looking perspective helps you position your portfolio ahead of industry transformations, not reacting after they’ve already happened.

Economic Indicator Correlation Analysis

Understanding how specific stocks respond to economic shifts can dramatically improve your timing. Perplexity AI excels at finding these relationships.

Ask “How do rising interest rates affect fintech stocks?” or “Show the correlation between oil prices and airline profitability.” You’ll discover:

- Which stocks are inflation-resistant

- How currency fluctuations impact multinational earnings

- Sector rotations during different economic cycles

- Interest rate sensitivity by company

- Employment trend effects on consumer discretionary stocks

- Powerful Perplexity AI Stock Analysis Techniques.

These insights help you adjust your portfolio based on macroeconomic forecasts, potentially sidestepping major drawdowns while capitalizing on sector-specific opportunities that others miss.

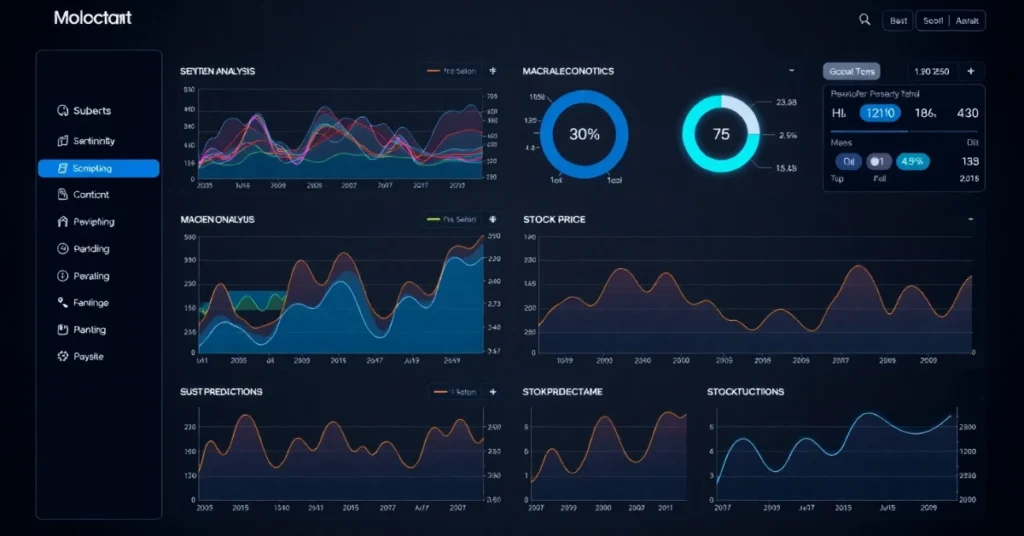

Technical Analysis Powered by Perplexity AI

Pattern Recognition Capabilities

Ever spotted a cup and handle pattern on a stock chart? Perplexity AI takes pattern recognition to another level. The AI doesn’t just identify classic patterns—it learns from millions of historical charts to spot nuanced variations that human eyes might miss.

You’ll get alerts when the AI detects emerging patterns across multiple timeframes. What’s game-changing is how Perplexity analyzes these patterns contextually. A head and shoulders formation in a tech stock during earnings season? The AI understands this context differs from the same pattern in a utility stock during rate hikes. Powerful Perplexity AI Stock Analysis Techniques.

Try running your watchlist through Perplexity’s scanner to catch patterns before they complete. Many traders report catching breakouts days before they appear obvious on charts.

Volume Analysis and Trading Signals

Volume tells you the truth about price movements—and Perplexity AI reads this truth with incredible accuracy.

You’re getting more than basic volume indicators. The AI correlates unusual volume with price action, news events, and market sentiment simultaneously. This multi-dimensional analysis helps you spot the difference between a genuine breakout and a false move. Powerful Perplexity AI Stock Analysis Techniques.

When you see Perplexity highlight divergences between volume and price, pay attention. These often signal upcoming reversals before traditional indicators catch up. The platform’s heat mapping of volume at specific price levels shows you exactly where the smart money is positioning.

Price Movement Prediction Models

Forget simple trend lines. Perplexity’s prediction models combine technical factors with market sentiment analysis to forecast potential price targets.

You’ll see probability cones rather than single price targets, giving you a realistic view of possible outcomes. The AI constantly recalibrates these predictions as new data arrives—unlike static models that quickly become outdated.

What makes these models truly powerful is their self-learning capability. When you track how the predictions perform over time, you’ll notice they become increasingly accurate for the specific stocks you follow most frequently. Powerful Perplexity AI Stock Analysis Techniques.

Try comparing Perplexity’s predictions against your own technical analysis to identify blind spots in your approach. Many traders find this comparison reveals biases they didn’t know they had.

Risk Assessment and Portfolio Management Strategies

Volatility Prediction and Management

Trying to manage market volatility without AI is like sailing without checking the weather forecast. With Perplexity AI, you get a powerful tool that spots potential market turbulence before it hits your portfolio.

The platform analyzes historical volatility patterns and current market conditions to give you actionable insights. You’ll see which stocks in your portfolio might face upcoming volatility spikes, allowing you to make preemptive moves. Powerful Perplexity AI Stock Analysis Techniques.

Want to know if your tech stocks will bounce around next week? Perplexity AI can tell you that—and suggest hedging strategies tailored to your risk tolerance.

Diversification Recommendations Based on AI Insights

Your portfolio might not be as diversified as you think. Perplexity AI goes beyond traditional sector-based diversification by uncovering hidden correlations between your holdings.

The AI examines thousands of data points to identify:

- Asset classes with inverse correlations to your current holdings

- Underrepresented market segments in your portfolio

- Geographic diversification opportunities you’ve missed

- Powerful Perplexity AI Stock Analysis Techniques.

You’ll receive specific stock recommendations that genuinely complement your existing investments, not just add more of the same risk in different packaging.

Automated Risk-Reward Calculations

Gone are the days of manually calculating potential outcomes for each trade. Perplexity AI automatically generates risk-reward scenarios for every stock in your watchlist.

For each potential investment, you’ll see:

- Projected upside based on multiple scenarios

- Downside risk with probability assessments

- Risk-adjusted return expectations

- Powerful Perplexity AI Stock Analysis Techniques.

This takes the emotional guesswork out of your decision-making process. Instead of wondering “what if,” you’ll have data-driven projections at your fingertips.

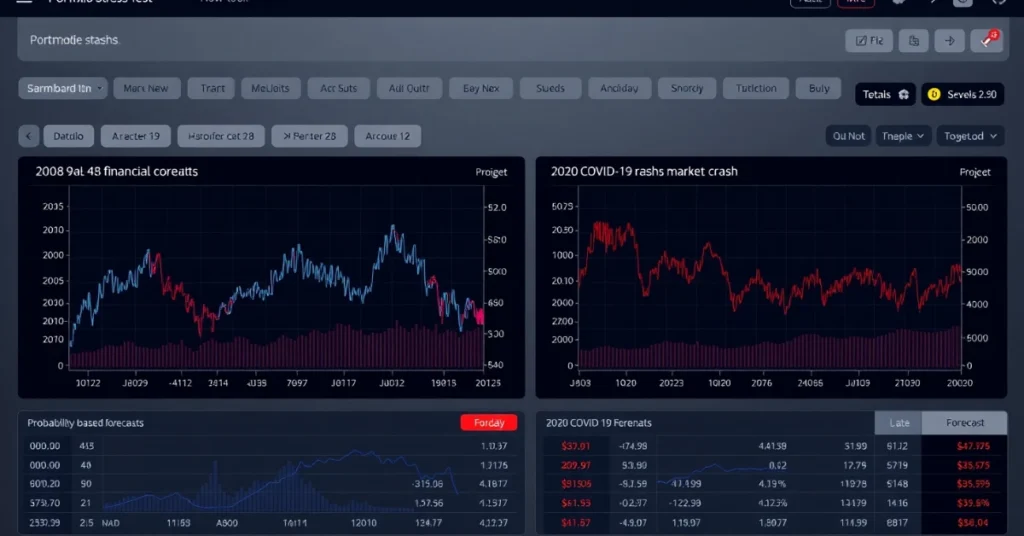

Stress Testing Your Portfolio with Perplexity AI

Market crashes don’t announce themselves. But with Perplexity AI, you can simulate how your portfolio would perform under extreme conditions.

Run custom stress tests that model:

- Historical crash scenarios (2008, 2020, etc.)

- Interest rate shock events

- Sector-specific meltdowns

- Personalized disaster scenarios

- Powerful Perplexity AI Stock Analysis Techniques.

The AI provides a detailed breakdown of how each holding would likely perform, allowing you to fortify vulnerable positions before real trouble hits. You can adjust position sizes based on these outcomes, ensuring your portfolio can weather whatever storms lie ahead.

Real-time Trading Applications

Setting Up Automated Alerts

Want to stay ahead of market movements? Set up automated alerts with Perplexity AI to trigger notifications when specific conditions occur. Start by defining your key indicators—whether price thresholds, volume spikes, or momentum shifts. You can customize alert parameters based on your trading style:

- Price-based alerts: Get notified when stocks hit support/resistance levels

- Pattern recognition: Receive alerts for chart patterns like head and shoulders or double bottoms

- Sentiment shifts: Track sudden changes in market sentiment from news analysis

- Powerful Perplexity AI Stock Analysis Techniques.

The magic happens when you layer multiple conditions. For example, set an alert for when a stock drops 5% AND trading volume increases 200% above average AND sentiment turns positive. These multi-factor alerts help filter out noise and focus on high-probability setups.

Integrating with Trading Platforms

Ready to take your Perplexity AI analysis directly to your trading account? Integration options now make this seamless. Most major platforms offer API connections that allow Perplexity AI to:

- Push analysis directly to your trading dashboard

- Auto-populate trading parameters based on AI insights

- Execute trades through your existing brokerage

- Powerful Perplexity AI Stock Analysis Techniques.

Setting up these connections typically requires API keys from your broker. Once connected, you can create custom workflows—like having your morning stock scan results automatically loaded as a watchlist in your trading platform.

The real power comes from combining Perplexity’s analysis with your platform’s execution capabilities. Think about it: your AI identifies an opportunity based on multiple data sources, feeds the parameters to your platform, and you’re ready to execute with a single click.

Backtesting Strategies with Historical Data

Wondering if your Perplexity AI strategy actually works? Backtesting is your answer. Load historical market data and run your AI-powered strategy through past conditions to see how it would have performed.

When backtesting with Perplexity AI, you’ll want to:

- Test across different market conditions (bull, bear, sideways)

- Account for slippage and transaction costs

- Run multiple iterations with varied parameters

- Powerful Perplexity AI Stock Analysis Techniques.

The platform’s ability to process alternative data sets alongside traditional market data gives your backtests extra depth. You can see how your strategy performs when correlated with social media sentiment, economic indicators, or even weather patterns affecting certain industries.

Remember to avoid overfitting—where your strategy works perfectly on historical data but fails in live markets. Split your historical data into training and testing sets to validate your approach.

Optimizing Entry and Exit Points

Finding the perfect moment to enter or exit trades can dramatically improve your returns. Perplexity AI helps fine-tune these critical decisions through multi-factor analysis.

For entries, leverage the platform to:

- Identify confluence zones where multiple indicators align

- Calculate optimal position sizing based on volatility

- Gauge market sentiment at potential entry points

- Powerful Perplexity AI Stock Analysis Techniques.

Exit strategies benefit even more from AI assistance. Set up dynamic exit rules that adapt to changing market conditions rather than static price targets. For instance, your exit strategy might adjust based on:

- Volatility expansion/contraction

- Changes in trading volume

- Shifts in underlying fundamentals

- Price action relative to sector performance

- Powerful Perplexity AI Stock Analysis Techniques.

The platform can continuously monitor your open positions against these factors, helping you stay in winners longer while cutting losers quickly. This dynamic approach beats simple stop-loss and take-profit levels that don’t adapt to changing market conditions.

Advanced Perplexity AI Techniques for Experienced Investors

Custom Algorithm Development

Ever felt limited by off-the-shelf stock analysis tools? Creating your own algorithms with Perplexity AI can be a game-changer. You don’t need a PhD in computer science to get started – just a clear investment strategy and some basic coding skills.

Start by identifying your unique edge. Maybe you’ve spotted patterns in small-cap stocks during earnings season, or perhaps you’ve noticed sector rotations following specific economic indicators. Your custom algorithm should capture these insights.

With Perplexity AI, you can build models that combine multiple factors:

- Price action signals

- Volume patterns

- Volatility metrics

- Fundamental data points

- Macroeconomic indicators

- Powerful Perplexity AI Stock Analysis Techniques.

The real power comes when you backtest your algorithm against historical data. You’ll quickly see what works and what doesn’t, allowing you to refine your approach before risking real capital.

Sentiment Analysis of News and Social Media

Think the market only responds to numbers? Think again. Sentiment drives prices, sometimes even more than fundamentals.

Perplexity AI excels at scraping and analyzing text data from:

- Financial news articles

- Earnings call transcripts

- Twitter/X and Reddit discussions

- Analyst reports

- SEC filings

- Powerful Perplexity AI Stock Analysis Techniques.

By tracking sentiment shifts around your holdings, you’ll spot potential price movements before they appear in the charts. The key is setting up proper filters to cut through the noise and focus on meaningful signals.

Many successful investors use sentiment scores as contrarian indicators – when everyone’s extremely bullish, they become cautious, and when fear dominates, they look for buying opportunities.

Alternative Data Integration

The secret weapon in your investment arsenal? Alternative data. While everyone else pores over the same financial statements, you’ll gain insights from:

- Satellite imagery of retailer parking lots

- Credit card transaction data

- App download statistics

- Web traffic analysis

- Job posting trends

- Powerful Perplexity AI Stock Analysis Techniques.

Perplexity AI helps you integrate these unconventional data sources with traditional metrics. The platform can identify correlations between, say, increasing job postings and future revenue growth, or declining web traffic and upcoming earnings misses.

Setting up dashboards that blend alternative and traditional data gives you a holistic view of companies that most investors simply don’t have.

Machine Learning Model Training and Optimization

Your ML models are only as good as their training. With Perplexity AI, you can continuously improve your investment algorithms through:

- Feature engineering – identifying which variables actually matter

- Cross-validation – ensuring your model works across different market conditions

- Hyperparameter tuning – optimizing your model’s sensitivity

- Ensemble methods – combining multiple models for better accuracy

- Powerful Perplexity AI Stock Analysis Techniques.

Don’t get discouraged if your first models underperform. Machine learning is iterative by nature. Each failure provides valuable data that helps refine future versions.

The most successful investors using Perplexity AI don’t just build models once – they constantly test, refine, and improve their approaches as markets evolve.

Conclusion: Mastering Perplexity AI for stock analysis

Mastering Perplexity AI for stock analysis can transform your investment approach and potentially lead to better financial outcomes. From understanding the core capabilities of this powerful tool to implementing advanced techniques, you now have a comprehensive framework to enhance your trading strategy. Whether you’re conducting fundamental analysis, technical analysis, or risk assessment, Perplexity AI offers valuable insights that traditional methods might miss. Powerful Perplexity AI Stock Analysis Techniques.

As you begin implementing these techniques, remember that consistency is key. Start with the basic setup and gradually incorporate more sophisticated strategies as you become comfortable with the platform. The real power of Perplexity AI lies in how you combine its various capabilities to create a personalized analysis system that aligns with your investment goals. Take action today by setting up your analysis environment and exploring how this innovative technology can help you make more informed investment decisions in an increasingly complex market.

Frequently Asked Questions (FAQs) About Powerful Perplexity AI Stock Analysis Techniques

What is Perplexity AI in stock analysis?

Perplexity AI is an advanced AI-driven platform that processes real-time financial data, sentiment, and alternative datasets to provide dynamic, context-aware insights for smarter investment decisions. Powerful Perplexity AI Stock Analysis Techniques.

How is Perplexity AI different from traditional stock analysis tools?

Unlike conventional tools that rely on static formulas and thresholds, Perplexity AI adapts dynamically, analyzing both financial metrics and non-traditional data like social sentiment and news context. Powerful Perplexity AI Stock Analysis Techniques.

Can beginners use Perplexity AI for stock analysis?

Yes. Beginners can start with simple prompts such as “Analyze Apple’s profit margins over the last 5 quarters” and get clear, easy-to-understand insights without needing deep financial expertise. Powerful Perplexity AI Stock Analysis Techniques.

What kind of data sources does Perplexity AI use?

It combines traditional sources (financial statements, price action, economic indicators) with alternative data (social media sentiment, satellite imagery, job postings, consumer spending trends). Powerful Perplexity AI Stock Analysis Techniques.

How does Perplexity AI improve fundamental analysis?

It extracts meaningful insights from income statements, balance sheets, and cash flows, highlighting key patterns like revenue growth, profit margins, and hidden liabilities that might otherwise be missed. Powerful Perplexity AI Stock Analysis Techniques.

Can Perplexity AI help with technical analysis?

Absolutely. Perplexity AI identifies chart patterns, volume trends, and probability-based price forecasts, often spotting breakouts or reversals earlier than human traders or traditional tools. Powerful Perplexity AI Stock Analysis Techniques.

How does Perplexity AI handle risk assessment?

It generates risk-reward calculations, volatility predictions, diversification insights, and even portfolio stress tests under scenarios like market crashes or sector downturns. Powerful Perplexity AI Stock Analysis Techniques.

Can Perplexity AI integrate with trading platforms?

Yes. Through API connections, it can push analysis directly into platforms like TradingView or MetaTrader, auto-populate trading setups, and even streamline execution workflows. Powerful Perplexity AI Stock Analysis Techniques.

Does Perplexity AI support backtesting strategies?

Yes. You can test strategies against historical market conditions—including bull, bear, and sideways markets—while factoring in social sentiment, transaction costs, and macroeconomic shifts. Powerful Perplexity AI Stock Analysis Techniques.

Who benefits most from Perplexity AI stock analysis?

Both retail and professional investors benefit. Beginners save time and avoid guesswork, while experienced traders gain advanced insights through custom algorithms, sentiment analysis, and alternative data integration. Powerful Perplexity AI Stock Analysis Techniques.

2 thoughts on “Powerful Perplexity AI Stock Analysis Techniques You Need to Know 2025”